Singlefamily Housing

Written by Jamie Younger, Picture Living Fund Director and Alex Notay, (former) Placemaking and Investment Director.

January 2024

In this article:

The Origins of UK Singlefamily Housing (SFH)

Brits are famously obsessed with property and particularly home ownership. We can all recognise the difference between a terraced or detached house and a garden flat or penthouse apartment, but the terminology used by residential investors has become much more complicated in recent years.

While the UK housing crisis has deepened, institutional investors from the UK and abroad have begun to invest heavily into rental housing. These offer customers the benefit of a professional and responsive landlord, offering security of tenure, responsive repairs and a range of amenities depending on the brand. Institutional investors are attracted to the stable income on offer, in a market where traditional real estate asset classes such as office and retail have experienced significant volatility. Pension funds especially like the long-term liability match; providing quality homes for customers, whose rent in effect contributes to their own pensions for later years.

The UK was late to the party in terms of institutional investment into the Private Rental Sector (PRS), a market still dominated by traditional private landlords. In the US, institutional ownership of rental housing is around 40%, making it the world’s largest market, but in the UK institutions own only 3% of rental flats and only 0.3% of rental houses. Much of this investment to date has been in the UK Purpose-Built Student Accommodation (PBSA) sector, which began to boom in the 1990s and continues to thrive as UK universities expand their domestic and international student intakes.

The August 2012 Montague Review highlighted the various regulatory barriers to institutions looking to access the PRS market, and catalysed a range of government interventions to support the ‘Build to Rent’ (BTR) market – i.e. homes designed, built and operated for long-term rental operations. For investors, this sector is often also referred to with the US term ‘multifamily’, meaning multiple separate housing units in a building or complex with one owner but multiple tenant occupants and is usually in largescale apartment blocks. In contrast, the US term ‘singlefamily’ refers to a freestanding residential building with a single owner and single occupier – what we in the UK would recognise as a standard house for sale or rent. These terms have also been adopted in Europe over the past decade.

Multifamily housing (MFH) is growing slowly but steadily in the UK, but in a challenging environment for all stages of delivery from land acquisition and planning to development and operations, it remains a nascent asset class. However, alongside this there has been a surge in institutional interest in rental portfolios of houses, often in suburban areas with good transport links and amenities. According to the OECD, 80% of the UK’s housing stock is houses rather than flats, so this is a very familiar product to the UK consumer. Operators and the market variously label this burgeoning asset class as Singlefamily housing (SFH) or sometimes singlefamily rental (SFR) or suburban BTR, hoping to attract institutional investors familiar with this type of rental housing in other markets. Just to confuse everyone that little bit more, the industry association UKAA (UK Apartment Association) is recommending the sector adopts the term Build to Rent housing, the label also adopted by Savills in its most recent research on the sector, so the terminology continues to evolve!

At Thriving Investments we talk about singlefamily housing. Unlike MFH, this product is not necessarily designed specifically for renting and is often at a much smaller scale. Thriving Investments (formerly PfP Capital) pioneered the SFH offer in the UK by launching our Picture Living platform in 2017, with investment from USS (Universities Superannuation Scheme). Often acquiring phases from housebuilders to be rented rather than sold, the Picture Living team have been able to build a portfolio of c. 1,800 homes across the UK.

As the UK deals with a cost-of-living crisis and home ownership remains out of reach for the vast majority of the population, the affordability and relative ease of delivery of SFH versus MFH is underpinning increasing interest from institutional investors from within and outside the UK.

In July 2023, JLL research highlighted that there were just 9,400 institutional SFH homes, but that investor commitments and pipelines would see this rise to over 50,000 homes by the end of 2025, reflecting a growth rate twice that of UK MFH. JLL continued to note that:

“In 2023, difficulties in financing typically larger built stock acquisitions solidified that slow-down. At the same time, the UK’s volume housebuilders have embraced investor sales as a key part of their sales model.

Some 76% of SFR investment in the UK focussed on new development, compared to 4% in the Netherlands. Strategic partnerships between builders and institutions have laid the foundation for investment, with often small schemes, that are less reliant on debt, pushing the UK to the top spot for Europe." - Emma Rosser, JLL

Below we investigate further some of the numbers behind this growth, why residents like the product, and why it is increasingly fitting with investors’ requirements.

Singlefamily Housing in Numbers

The number of households in the UK has increased by more than 1.4 million in the last 10 years. This tallies with the 2018 ONS prediction of 7.1% growth by 2028. At the same time, the 25-year prediction from 2018 was that the number of households would grow to 27 million. Supporting those figures, H1 2023 saw a net migration of 672,000 which was higher than the pre-Covid 5-year average of 500k p.a.

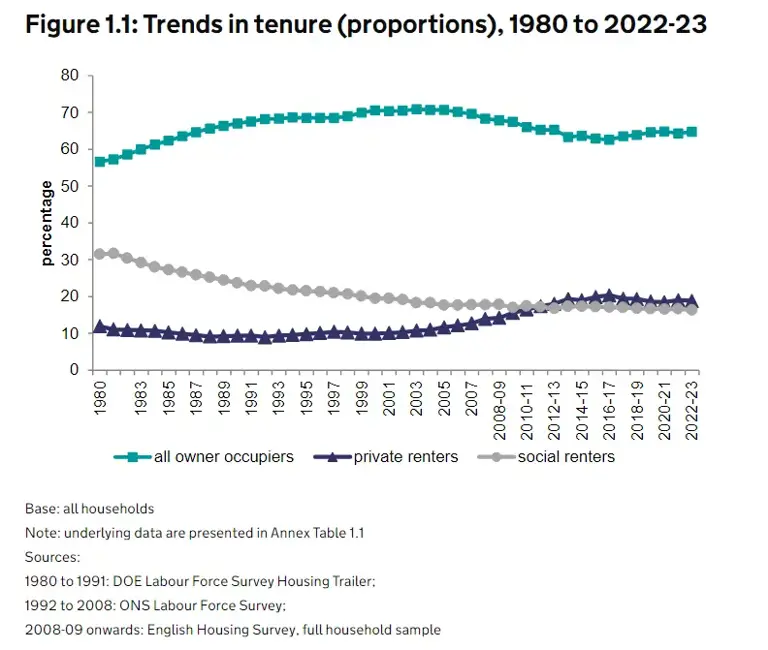

Whilst more people in the UK own their own homes than rent (62.5% or 15.5 million vs 37.5% or 9.3 million households), the number of rental properties in the UK increased by 25% between 2011 and 2021. While home ownership has also increased in absolute terms, it has decreased as an overall percentage from 64.3% to 62.5%. This is part of a longer-term decline in home ownership from the peak in early 2000’s, following rapid growth in the 1980’s as result of the introduction of ‘right to buy’, with changes in the 2000’s making buying a local authority rented home both more expensive and difficult.

Source: ONS

Of the 9.3 million people renting a home in the UK, there are 5.2 million private renters and 4.1 million social renters (i.e. via a local council or housing association where a proportion of the rent is covered by government subsidy).The last 10-years has seen a large increase in private rented provision of over 30%, or 1.3 million households. The most recent data suggests the PRS market is worth £1.4 trillion, with just 5% of this comprising socially rented housing.

With the delivery of new homes in the UK at its lowest since the end of WW2, demand for housing of all tenures has never been higher. At the same time, home ownership has become increasingly unaffordable. UK homebuyers are required to pay 10.6 times their average annual salary to afford the average home, which presents a massive financial hurdle even before fluctuating interest rates impact the viability of mortgage repayments.

Given the shortage of housing stock across all tenures, the increased demand for rental homes has pushed rents to rise at their fastest rates in over a decade. The British cultural obsession with home ownership has been reinforced by the very poor quality of traditional Private Rented Sector homes. The 2022-23 English Housing Survey highlights that 23%, or 990,000, occupied private rented sector dwellings are estimated to fail the Decent Homes Standard. This is a higher proportion than in the social rented sector (10% or 380,000 dwellings) and in the owner occupied sector (13% or 2 million dwellings).

Therefore one of the main priorities of institutional investors has been to differentiate their customer offer, whether MFH or SFH, by offering decent and indeed high-quality homes that are both sustainable and affordable to run, with secure tenancies and responsive management.

On the supply side, the providers of housing (both private and social) have faced various head winds which have been well documented: competition for land, planning challenges, cost price inflation, and availability and cost of debt. The fluctuations in local planning authority housing targets has also impeded the certainty and clarity that investors require in order to fund the delivery of new housing, which is currently is at 180,000 for England and Wales and 210,000 for the UK. The 300,00 new homes per year target has been downgraded to ‘advisory’, yet the demand continues to surge.

With private landlords downsizing in record numbers – Britain’s rental sector has lost an estimated 127,000 properties since 2022 – the onus has fallen on the BTR sector to meet demand. According to the BPF, there are now 263,694 BTR homes in the UK, including both London and the regions, of which 92,140 are complete, 59,043 under construction and 112,511 in planning.

The Singlefamily Housing Resident

Who is the typical SFH tenant? What do they like about their homes and the SFH rental experience? How long do they stay for?

At Thriving Investments, we are continuously crunching the data that our property manager, Touchstone , provides, whilst we undertake regular customer surveys and have access to immediate customer reactions via the Residently app that our residents can use.

Broader insights are also revealed in Savills’ seminal report on the BTR sector The Future of Build to Rent Houses, which Thriving Investments and many other institutional investors contributed to.

Takeaways from both of the above include:

- SFH benefits from a high diversification of occupier, with young families, who are attracted to affordable family homes in communities with good schools and amenities suitable for young children, the largest occupier group (41%). SFH is equally popular with young couples / singles (20%) and established families (41–60-year-olds with children) (19%).

- SFH is popular with the younger demographic of the private rental market, with nearly 90% of occupiers under 45 years old, compared to 51% across all rental housing.

- The most common employment type is professional occupations, covering nurses, teachers, and social workers (31%).

- The report also found the average distance renters moved to SFH schemes was 4.5 miles, highlighting that customers tend to want to stay within reach of a particular neighbourhood if they can afford to do so.

- The top three things that residents value are: local amenities, quality of management and the ‘fitout’ of the properties (fitted kitchens, white goods included, high quality flooring etc.)

- Our own data underlines that location comes first, followed by price, and then ease or peace of mind.

- Tenants want security of tenure. This is understandable if they are moving to a new area for work or schools – they don’t want an individual private landlord deciding to sell the home because they are retiring or their mortgage cost has gone up.

- Over 65% of Thriving Investments residents expect to be in their current home for over two years.

Investors

SFH is increasingly becoming an institutional product that should benefit from both near-term and long-term tailwinds, and will become a key allocation in investor portfolios. As it becomes more mature, so investors are becoming more comfortable with the operational model and reputational risks. As investor and professional advisor’s knowledge and experience of the sector has deepened, and more product is delivered into the market, so the risk / return profile of the SFH sector is becoming more attractive.

We think the SFH product is an attractive investment product for a number of reasons:

- The inflation-linked income characteristics

- The demand supply dynamics, which, underpinned by a shortage of product, should underpin strong rental growth. UK rental growth has been above 10% year-on-year for 19 consecutive months

- The liability matching characteristics are appealing for institutions looking for a bond proxy

- The lower gross to net income operational costs vs MFH – often due to less amenity space such as gyms or communal working areas, and internal infrastructure like lifts – and its low rise design reduces health and safety risks

- A ‘stickier’ tenant base, meaning reduced void levels and minimising the associated loss of income

- A more granular income stream from multiple tenants

- SFH properties are currently trading at a discount to underlying vacant possession value (providing downside risk mitigant)

- The environmental performance is easier to drive forward, due to the granular nature of the properties. On the S side they provide an essential housing need and have a strong community feel

- It is generally a more de-risked product. To date most stock has been delivered by the large housebuilders or through forward funding schemes, and, unlike with MFH, schemes can be released in phases, generating earlier income

- More broadly, residential returns not only have a low correlation with other asset classes in the property sector, but also equities and bonds.

Whilst there is an elevated risk profile for SFH investors seeking higher returns – where they are happy to take on planning and development risk – we think it is hard to beat for core or core plus investors seeking non-correlated, inflation-linked returns. And it looks like the market agrees – according to Knight Frank, 71% of investors plan to invest in the SFH sector in coming five years, up from 45% today.

Please contact Jamie Younger to discuss singlefamily opportunities with Picture Living

News

Latest News

25 March 2025

Thriving Investments launches £200 million Greater Manchester essential worker housing fund

27 January 2025

New Thriving Investments and Gresham House partnership makes first investment with £53 million to forward fund 122 homes

19 December 2024